Walk around any shopping mall, pop your head into any office cafeteria or consciously view the next social interaction with your friends and you’ll notice a pattern: everyone has a mobile phone and will use it at some point in the day.

In the last five years, technology and human innovation has advanced hundreds of times faster than the previous five decades combined.

Source: Wait But Why

Your business might not be ready for it, but mobile is the biggest variants currently driving digital transformation.

Mobile technology advancements are so great that many people don’t need a laptop anymore. Banking, buying consumer goods, booking flights, playing games, interacting on social media, listening to music, video, and apps like WhatsApp allow us to centralize all our apps and tools into a seven-inch mobile device.

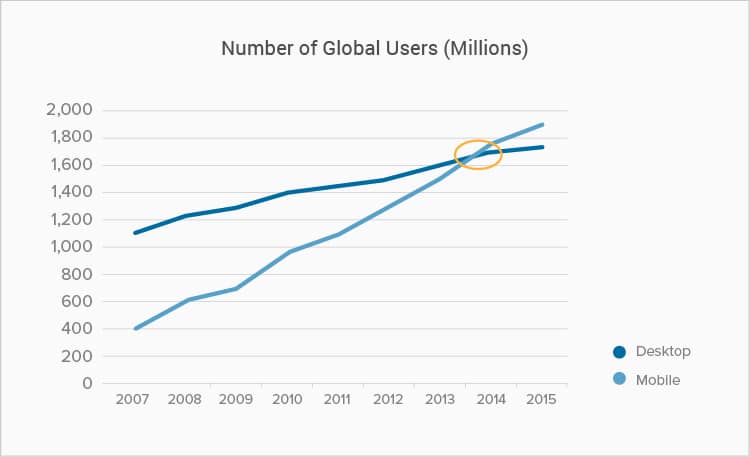

The convenience factor is great – so great in fact that more people use a mobile to access the Internet than desktop.

Source: Smart Insights

Google also went on record to state that its search platform is receiving more mobile searches in first-world markets such as the United States and Japan and they have such confidence in the transition that their primary results database is now their mobile version. As of Q4 2016 Google desktop results will be updated weekly and take a secondary import to their mobile results processing.

There’s little debate that the world is using mobile more and more, but how is it driving digital transformation?

Mobile – the Vehicle for Digital Transformation

The most recent example of mobile driving digital transformation is Uber – a 100% mobile app-based business worth a staggering $50 billion.

Most of the coverage about Uber has focused on the controversial use of contract labor and skirting of regulatory rules to achieve faster growth. Their entire model though is predicated on their ability to instantly locate and communicate with customer, a feat achieved via widespread adoption of smart phones. Uber is impossible on a desktop.

Thought I do admit that as clear a case for Uber being driven by mobile might be, we’re used to seeing Silicon Valley startups leverage new technologies to disrupt existing business systems.

How have legacy companies such as big box retailers successfully applied mobile first thinking to drive their digital transofrmation strategies? Far from the world of startups, Home Depot is a traditional, big box retailer that has not only survived the retail apocalypse but has actually grown because of mobile. Home Depot CEO Craig Menear said:

“Today’s consumer wants to shop whenever, wherever, and however they want, whether that’s in store, on their phones, or via an app.”

In 2014, Home Depot said they would need to spend as much as $1.5 billion (yes, billion) to meet customers’ needs and effectively plan their digital transformation.

Recognizing the phenomenom of people using mobile phones in store to check prices and comparison shop, Home Depot decided to embrace their new mobile users and develop a highly interconnected retail experience. Home Depot can only stock about 35,000 physical products in their stores, but their digital warehouse contains over 700,000 products and they can leverage their already robust inventory management chain to move those online products to physical locations for in-store pick-up.

The result? Home Depot grew their e-commerce revenue by more than $1 billion in 2015, a 36% increase from the year before. From the online sales, 40% of online purchases were collected in-store, through omnichannel marketing. Home Depot had to admit that even they were not prepared for the speed at which its customers adopted and integrated mobile habits with their in-store shopping experience.

One group that didn’t take long to notice is Wall Street. Since January 2014 when Home Depot started their “mobile first” digital transformation, the company share price has increased by 50%.

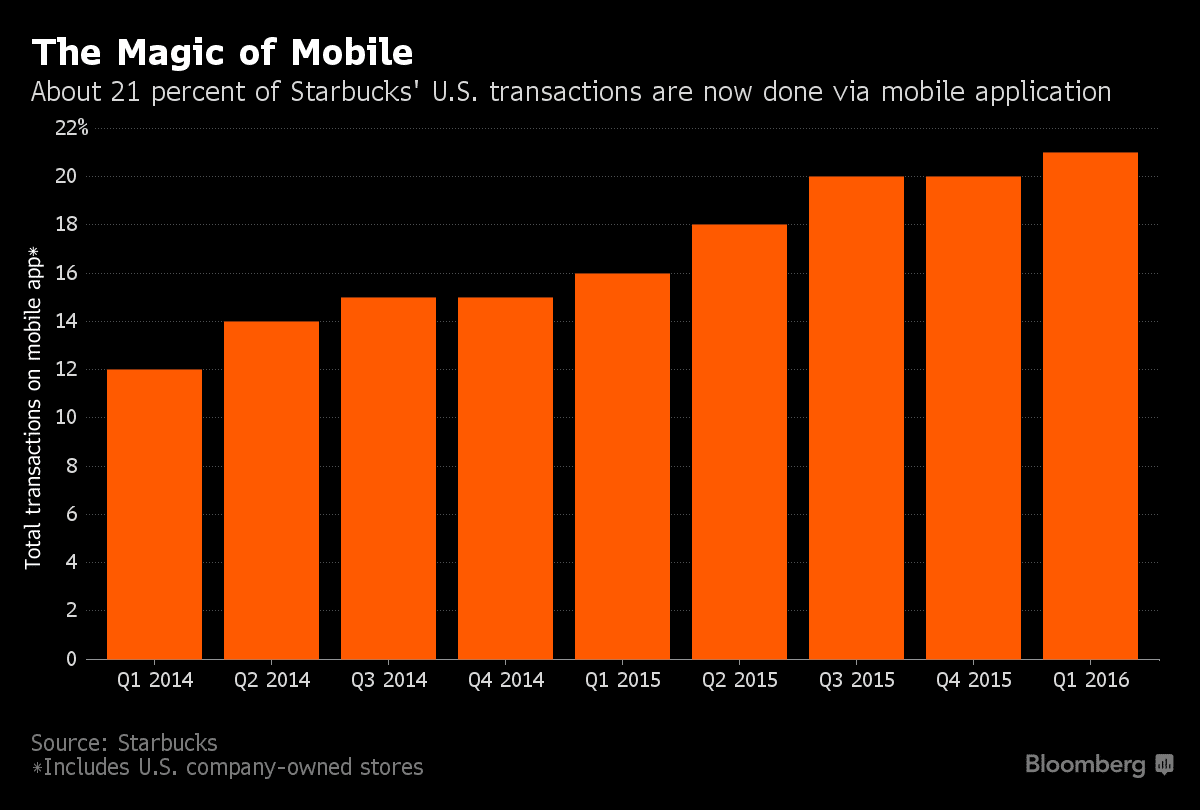

Starbucks is another business that leveraged mobile as their lead point into digital transformation and have used it to provide a seamless, omni-channel customer-first strategy. While other brands were building mobile apps that imitated their online store, Starbucks created what they call an end-to-end consumer platform anchored around loyalty.

With the StarBucks app installed, smartphones now faithfully alert customers to approaching Starbucks stores, offers to order their favorite drink so it’s waiting upon arrival and eliminate the need to even think about payment beyond a few thumb prints. By adding gameification and loyatly programs to the app Starbucks is able to keep a steady stream of contextually relevant and personalized offers to their existing customer base, while at the same time drastically improving customer experience by eliminating waits in a queue.

Customers loaded around $1.9 billion onto their Starbucks card in the first quarter of 2016, an 18% increase on the year before. The amount of data Starbucks captured about their audience’s behaviors and buying patterns through their two apps allows them to create targeted promotions and predict how their customers will react next.

With this data, they can anticipate and take action before customer sentiment changes, and they can stay ahead of consumer needs.

As of this writing Starbucks estimates that 21% of their transactions are already taking place on mobile devices, with that amount certain to continue its rapid increase.

Source: Bloomberg

Moving out of retail, the banking sector is one that is rarely thought of as the either being at the forefront of consumer facing technology or customer service. However a quiet revolution is taking place in the banking industry.

Many big name banks such as Bank of America and Chase have quietly undertaken mobile first digital transformation for their customer service protocols and the results have been truly remarkable. Online banking has been an internet staple since Web 1.0 but the user experience was always far from pleasant. Most interactions still required a phone call or a visit to an ATM or branch.

Those days are now over.

Customers can now deposit checks, transfer money, and pay bills right through their mobile phone all by making a handful of taps. For those few times a customers does have to go into a branch for what are now rapidly decreasing reasons, digital kiosks with user experiences that remember the customer and mirror the mobile experience await.

The results have been a first of its kind turnaround in customer service perception for a major provider in the digital era. Consumers, particularly millennials, are starting to like their banks again.

My colleague Steve Rosenblum has an excellent analysis of this transformation and the long term outlook in his two part series – here.

These companies are creating a new customer engagement experience that is only possible through a mobile device. In all of these cases, companies are not simply adding a mobile component or a responsive view to a desktop storefront and calling their mobile strategy done.

They are fundamentally rethinking their businesses and putting mobile at the front of strategic decision making.

The examples of Uber, Starbucks, Chase and Home Depot show that mobile transformation is not limited to certain industries or segments – it can be applied to every business model if you plan correctly.

Mobile transformation is still in its infancy stage and so far, it is only being adopted by the innovators. Do you want your business to be an innovator in your niche or a late adaptor?